Integrating Bitcoin into Amazon’s Corporate Strategy

Subject: Strategic Adoption of Bitcoin as a Treasury Asset and Operational Synergy: A Hypothetical Vision of Amazon Bitcoin Adoption

Corporate Bitcoin adoption is on the rise, and Amazon is primed to benefit with unique capabilities. More than just a treasury asset, this hypothetical "2-pager" narrative makes the case for full-scale integration.

Every company needs a Bitcoin strategy. This is a hypothetical vision of what that could look like for Amazon. The content, actions, and recommendations presented are my own, with no input or involvement from Amazon.

1/ Bitcoin Overview and Market Adoption

Bitcoin, launched in 2008 by Satoshi Nakamoto, operates as a decentralized digital currency on a blockchain—a distributed ledger secured by cryptographic proof-of-work. Its fixed supply of 21 million coins ensures scarcity and resists inflation, unlike fiat currencies. As of April 1, 2025, its market cap is $1.64 trillion | 15,783,952 BTC, reflecting a 137% growth in 2024, outpacing the MAG7 average of 28%.

Corporate adoption is robust: over 60 public companies hold Bitcoin as a treasury asset, including MicroStrategy (506,137 BTC), Tesla (9,720 BTC), and Block (8,027 BTC), totaling 523,884 BTC (Bitcoin Treasuries). MicroStrategy’s stock rose 370% in 2024, driven by its 2020 Bitcoin strategy. Governments are active—Bhutan holds $1 billion | 9,624 BTC in BTC, and the U.S. explores a strategic reserve by 2025. The FASB’s December 2024 fair-value accounting shift boosted Tesla’s balance sheet by $300 million | 2,887 BTC. Spot Bitcoin ETFs, approved in January 2024, manage over 1 million BTC, and pension funds in Japan and the U.S. allocate 1–2% to BTC. Amazon can lead as a first mover.

2/ Amazon’s Unique Synergies with Bitcoin

Amazon’s strengths—AWS data center expertise, sustainable energy and power partnerships, AI capabilities, chip design, and device innovation—align with Bitcoin’s ecosystem, offering unique synergies.

AWS Sovereign Mining Network: Target 5% of Bitcoin’s hash rate by 2030 using stranded energy (e.g., flare gas), advantaged access to electricity pricing, and open-source tech, holding mined BTC long-term (Bias for Action, Ownership). Strategic acquisitions of existing mining companies and their Bitcoin holdings can accelerate implementation. Leveraging chip design capabilities (e.g., Graviton), the company can research and bring to market new ASIC miners, creating competitive advantage in block win rate. With solo mining trends on the rise, Amazon will productize an open source, affordable home miner to promote Bitcoin decentralization (e.g. “Amazon Basics” solo miner). (Invent and Simplify, Customer Obsession)

Amazon Sovereign Wallet: Develop an open-source Bitcoin hardware wallet using Devices expertise (Alexa, Fire), paired with a Prime Bitcoin Sovereignty Program offering BTC rewards and custody education, onboarding millions. Bitcoin hardware wallets should be as ubiquitous as Ring doorbells or Alexa devices. (Invent and Simplify, Customer Obsession)

Amazon Pay Bitcoin Integration: Enable BTC payments for digital goods (Kindle, Prime Video) via Amazon Pay, exploring Lightning Network for faster, cheaper transactions. (Customer Obsession, Deliver Results). Fully integrated, seamless payments, when combined with wallet and loyalty program, accelerate Bitcoin's global adoption.

AI Use Cases: AWS AI can automate BTC transactions in workflows (e.g., supply chain settlements), embedding Bitcoin operationally. Agentic workflows exchanging monetary value will leverage the Bitcoin network for permissionless final settlement. (Think Big, Invent and Simplify)

These leverage Amazon’s scale for competitive advantage.

3/ Addressing Bitcoin Myths

Bitcoin faces skepticism—volatility, environmental impact, regulation—but strategic mitigation resolves these.

Volatility: Bitcoin’s 80% drop in 2022 contrasts with its 1,246% five-year growth vs. MAG7’s 246%. A “Bitcoin Treasury Lock” (10% of cash, $8.8 billion | 84,694 BTC by 2026, no-sell for 20 years) branded “Amazon’s Bitcoin Vault” embraces long-term value. (Earn Trust, Ownership)

ESG Impact: Mining uses 150 TWh annually, with 54% renewable (Bitcoin Mining Council). A Carbon-Neutral Bitcoin Pledge—100% renewable operations by 2027 via our $2 billion | 19,249 BTC Climate Pledge Fund—creates “Amazon Green BTC.” Studies (EPRI 2024, Cambridge 2023) show mining stabilizes grids by absorbing excess renewables. (Success and Scale, Deliver Results)

Regulation: U.S. ETF approvals and reserve talks signal support. Self-sovereign tools (wallets, mining) position ahead of global uncertainty. (Insist on the Highest Standards)

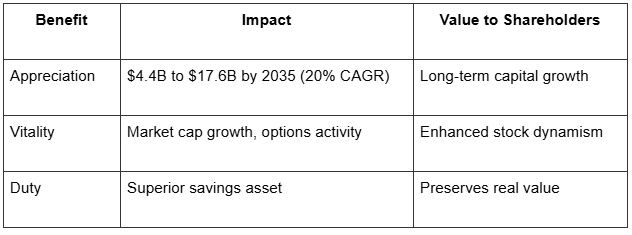

4/ Shareholder Benefits

Integrating Bitcoin into $88 billion | 846,944 BTC cash reserves drives value through appreciation, vitality, and duty.

Price Appreciation: A $4.4 billion | 42,347 BTC BTC stake today, assuming a conservative 20% CAGR (below Bitcoin’s historical 10-year average of 100%+), could grow to $17.6 billion | 169,389 BTC by 2035. This long-term view leverages Bitcoin’s scarcity, outpacing traditional assets like equities (S&P 500 CAGR 10%) and bonds (3%).

Stock Vitality: MicroStrategy’s experience shows BTC exposure drives market cap growth—its $16 billion | 153,990 BTC BTC holdings boosted its valuation by 370% in 2024—and increases options market activity, with higher trading volumes reflecting investor interest. Amazon could see similar dynamism with a well-communicated, long-term hodl strategy, enhancing stock appeal through accretive capital raise and intelligent leverage.

Fiduciary Duty: Bitcoin is the best asset for savings as cash loses purchasing power (CPI at 4.95%) and bonds underperform (10-year Treasury yields at 4.3% vs. inflation). MicroStrategy’s $16 billion | 153,990 BTC BTC profit highlights its superiority over cash or debt instruments eroding in real terms.

5/ Next Steps

To implement:

Investigations: Model an $8.8 billion | 84,694 BTC BTC lock by 2026 with a Pilot Metrics Dashboard (treasury yield, mining ROI, wallet adoption). Assess a 15 EH/s AWS mining network by Q4 2025 using flare gas/renewables and advantaged power access. Prototype the Sovereign Wallet by Q3 2025. (Think Big, Bias for Action)

Business Units: Establish a Bitcoin Treasury Unit (purchases, custody), Mining Innovation Group (AWS, home mining), and Sovereignty Division (Prime Program, wallet). (Invent and Simplify, Deliver Results)

Actions: Buy minimum $1 billion | 9,624 BTC BTC in Q2 2025. Seed $500 million | 4,812 BTC in Amazon Ventures for BTC startups (mining tech, wallets), targeting 20% IRR by 2027. Commit to 100% renewable BTC operations by 2027. (Ownership, Success and Scale)

6/ Conclusion and Recommendation

Bitcoin’s momentum—corporate success, ETF growth, government interest—offers Amazon a first-mover edge, aligned with its open-source ethos. AWS mining, sovereign wallets, Pay integration, and operational synergies position it to lead. Renewable mining and regulatory clarity debunk myths, while shareholders gain from long-term appreciation, stock vitality, and fiduciary duty, with risks mitigated by strategic planning and metrics.

Recommendation: Adopt Bitcoin as a treasury asset with a minimum $1 billion | 9,624 BTC buy in Q2 2025, scaling to $8.8 billion | 84,694 BTC by 2026 under a “no-sell” lock. Launch AWS Sovereign Mining Network, Amazon Basics Solo Miner, Sovereign Wallet, and Prime Bitcoin Sovereignty Program by 2026. This bold move, though potentially misunderstood, secures Amazon’s future dominance.

O21 Solutions

Companies ready to act can partner with O21 Solutions to navigate the Money Transition and develop a tailored Bitcoin strategy. Our expertise enables us to help companies assess their unique capabilities, competencies, and needs relative to Bitcoin, creating and implementing a strategy to ‘get off zero.’ This approach is customized to each company’s long-term strategic objectives, whether adopting Bitcoin as a treasury asset, integrating it into operations, or incorporating it into service offerings.

Mathieu Agee, Founder, O21 Solutions LLC